Carmignac Emergents: Letter from the Portfolio Manager

During the last three months of the year, Carmignac Emergents (A EUR Acc) recorded a performance of +24.1% versus 14.7% for its reference indicator. In 2020, the Fund returned +44.7%, outperforming its reference indicator that was up only +8.5%.

The Emerging Market

In 2020, despite the pandemic that wrecked the world economy, emerging markets were supported by increased global liquidity, driven by dovish central-bank policies, with Fed and the ECB expanding their balance sheets very aggressively to finance large fiscal stimulus programs. Emerging markets were also up during the last quarter, driven by the Biden victory in the US elections and the approval of vaccines, fuelling hopes that pandemic fears will be behind us after the first half of 2021.

Portfolio Management

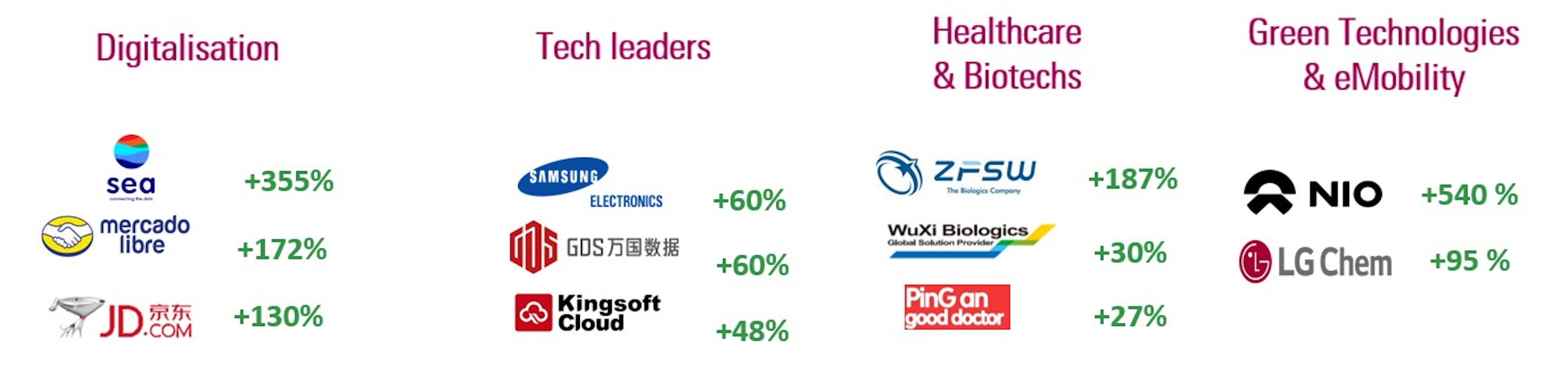

2020 will be remembered not only for the pandemic, but also as the year in which the digital revolution accelerated dramatically. Lockdown measures have benefited e-commerce players, with an unprecedented boost in adoption of all sorts of digital services. Carmignac Emergents has been positioning itself on this theme for years, increasing its exposure to the digital world and to investment themes that will be the main beneficiaries of this revolution on all continents and in all sectors.

- For example, in Latin America we have been investing in Mercado Libre, the leader in eCommerce and online payments since 2015. In Southeast Asia with Sea, a gaming platform that has grown into a giant in online commerce. In Russia with Yandex, the Russian search engine that takes market share from Google every year and has extended its ecosystem to cabs by merging with Uber in Russia. In Poland with Allegro, the "Polish Amazon". In Korea with Samsung Electronics.

- And what about China? We have been avoiding the companies of the old economy (banking, construction, mining), investing instead in the growing New Economy sectors, with investment themes geared towards the digital revolution the such as the Cloud (Kingsoft Cloud, Ming Yuan Cloud), e-commerce (JD.com, VIP Shop), or healthcare (Ping An Good Doctor, Zhifei, Wuxi Biologics).

These thematic positioning choices, favoring beneficiaries of digital revolution, along with good stock picking decisions explain the performance of the fund in 2020

Another key point worth highlighting: Our "Socially Responsible" investment approach embedded in our investment process also greatly contributed to the fund's performance in 2020.

How? By making us stay away of oil companies, almost all of which are owned by the governments or avoid airline & mining companies with past controversies, favoring instead companies that have positive impact on environment or societies, by trying to improve the living standards within emerging countries. We can give the example of our investments in the green mobility thematics, with our investments in electric vehicle production chain (leading battery manufacturer LG Chem in Korea, Nio “the Chinese Tesla” in China) contributing positively to performance in 2020.

*For the A EUR Acc share class. Reference indicator : MSCI EM NR USD converted into EUR.

Investment Outlook

After this very special year 2020, we ask ourselves the following questions:

- With mass vaccination and the gradual return to normal, are we going to see a return to favor of neglected themes such as cyclical values or so-called "value" values? Will the EMEA and Latin America regions rebound?

- Will emerging equities finally outperform after a decade of marked underperformance?

The increases in the size of US and European central bank balance sheets implemented at the time of the lockouts and to finance fiscal stimuli are leading to an unprecedented increase in global liquidity. A bearish cycle on the dollar seems very likely and it is very positively correlated with positive performance for emerging markets. North Asian economies have grown faster than developed countries while benefiting from much lower fiscal and monetary stimuli. Their economic fundamentals are therefore stronger than those of the developed countries. This is why, most of our investments remain and will remain focused on this region, which has very high potential growth in our view.

However, good long-term geographic & thematic allocation choices, are not, by themselves enough to deliver solid risk adjusted returns. It is crucial to take into account cyclical and sector rotations and manage the portfolio actively to adapt to a changing environment to seize the opportunities as they arise. That is why, we try to remain disciplined in position sizing & profit taking, constantly reviewing fundamentals, valuations, target prices of companies & countries we invest in.

Therefore, during the fourth quarter of 2020, we made a few adjustments to our positioning to take into account cyclical rotation in markets:

We have increased our exposure to the EMEA and Latin America regions, and to countries with less strong but improving macro fundamentals, as the depreciation of currencies has led to a drastic rebalancing of their balance of payments. It is the case of Brazil; whose current account is in surplus for the first time in 14 years. We accordingly stepped up our exposure to the country, along with Russia posting decent and improving fundamentals as well.

Finally, we also rebalanced the portfolio towards more cyclical assets in order to take advantage/benefit as much as possible from the rebound we expect from emerging markets in 2021. We increased our exposure to “value” or quality cyclical companies with very attractive valuations such as Samsung Electronics or Hyundai Motor in Korea.

Rendement

| Carmignac Emergents | 1.4 | 18.8 | -18.6 | 24.7 | 44.7 | -10.7 | -15.6 | 9.5 | 4.6 | -0.5 |

| Referentie-indicator | 14.5 | 20.6 | -10.3 | 20.6 | 8.5 | 4.9 | -14.9 | 6.1 | 14.7 | -1.3 |

| Carmignac Emergents | + 2.8 % | + 8.3 % | + 3.1 % |

| Referentie-indicator | + 2.4 % | + 8.3 % | + 3.6 % |

Bron: Carmignac op 31 mrt. 2025.

Het beheer van dit deelnemingsrecht/deze klasse is niet gebaseerd op de indicator. In het verleden behaalde resultaten en waarden bieden geen garantie voor toekomstige resultaten en waarden. De vermelde rendementen zijn netto na aftrek van alle kosten, met uitzondering van eventuele in- en uitstapkosten, en worden verkregen na aftrek van kosten en belastingen die van toepassing zijn op een gemiddelde detailhandelsklant die als natuurlijke persoon woonachtig is in België. Wanneer de valuta afwijkt van uw eigen valuta, bestaat er een valutarisico dat kan resulteren in een waardedaling. De referentievaluta van het fonds/subfonds is de EUR.

Referentie-indicator: MSCI EM NR index

Carmignac Emergents A EUR Acc

- Aanbevolen minimale beleggingstermijn*

- 5 jaar

- Risicoschaal**

- 4/7

- SFDR-fondscategorieën***

- Artikel 9

*Aanbevolen minimale beleggingstermijn: Dit deelnemingsrecht/deze klasse is mogelijk niet geschikt voor beleggers die voornemens zijn hun inleg voor afloop van de aanbevolen termijn op te nemen. Deze verwijzing naar een beleggersprofiel is geen beleggingsadvies. Welk bedrag redelijkerwijs in een ICBE kan worden belegd hangt af van uw persoonlijke situatie en moet worden bekeken in relatie tot uw totale portefeuille. **Het profiel kan variëren van 1 tot 7, waarbij categorie 1 overeenkomt met een lager risico en een lager potentieel rendement, en categorie 7 met een hoger risico en een hoger potentieel rendement. De categorieën 4, 5, 6 en 7 impliceren een hoge tot zeer hoge volatiliteit, met grote tot zeer grote prijsschommelingen die op korte termijn tot latente verliezen kunnen leiden. ***De Sustainable Finance Disclosure Regulation (SFDR) 2019/2088 is een Europese verordening die vermogensbeheerders verplicht hun fondsen te classificeren zoals onder meer: artikel 8 die milieu- en sociale kenmerken bevorderen, artikel 9 die investeringen duurzaam maken met meetbare doelstellingen, of artikel 6 die niet noodzakelijk een duurzaamheidsdoelstelling hebben. Voor meer informatie, bezoek: https://eur-lex.europa.eu/eli/reg/2019/2088/oj?locale=nl.

Voornaamste risico's van het Fonds

Risico's die in de indicator niet voldoende in aanmerking worden genomen

Tegenpartijrisico: Risico van verlies indien een tegenpartij niet aan haar contractuele verplichtingen kan voldoen.

Inherente risico's

Aandelen: Aandelenkoersschommelingen, waarvan de omvang afhangt van externe factoren, het kapitalisatieniveau van de markt en het volume van de verhandelde aandelen, kunnen het rendement van het Fonds beïnvloeden. Opkomende Landen: De nettoinventariswaarde van het compartiment kan sterk variëren vanwege de beleggingen in de markten van de opkomende landen, waar de koersschommelingen aanzienlijk kunnen zijn en waar de werking en de controle kunnen afwijken van de normen op de grote internationale beurzen.Wisselkoers: Het wisselkoersrisico hangt samen met de blootstelling, via directe beleggingen of het gebruik van valutatermijncontracten, aan andere valuta’s dan de waarderingsvaluta van het Fonds.Discretionair Beheer: Het anticiperen op de ontwikkelingen op de financiële markten door de beheermaatschappij is van directe invloed op het rendement van het Fonds, dat afhankelijk is van de geselecteerde effecten.Recente analyses

Carmignac Portfolio Emergents: Brief van de Fondsbeheerders

Zuidoost-Azië: Een grootmacht in de maak

![[Management Team] [Author] Hovasse Xavier](https://carmignac.imgix.net/uploads/NextImage/0001/18/%5BManagement-Team%5D-%5BAuthor%5D-Hovasse-Xavier-1.png?auto=format%2Ccompress&fit=fill&w=3840)