Fondsen Focus

Carmignac Patrimoine: Letter from the Portfolio Manager

- Gepubliceerd

-

Lengte

4 minuten leestijd

Market environment

In our previous report, we wrote: “A victory for the Democrats in the White House and Senate would clear the decks for a sweeping multi-year stimulus programme oriented towards demand.” That victory has now come to pass and has set the stage for a more Keynesian approach with three key components: an infrastructure programme tied to the energy transition; redistribution of income to the middle class, with policies spanning education and healthcare; and greater regulation of Big Tech. US policymakers will address these issues over time, whereas the pandemic calls for a new aid package now that includes cheques for low-income households, an extension of unemployment benefits and federal aid to state governments. Meanwhile, in December the European Central Bank (ECB) met market expectations on the size of the additional QE measures. The Bank has extended its asset purchases for another fifteen months to cover a large supply of bonds expected all the way up through the first quarter of 2022 and “preserve favourable financing conditions”. The ECB will henceforth be acting more to hold yields steady than to lower them.

Continued support from Central banks and governments has continued fuelling the recovery in equities. It has been driven by growth stocks from the lows of March. However, in the last months of the year, value stocks rebounded sharply, both in the developed and emerging world. In fact, the news of a Covid 19 vaccine in November acted as an additional boost for markets. The names that had lagged the most in 2020, namely airlines, banks and energy companies, rallied sharply on the back of this news and reduced some of the underperformance that had occurred versus their growth stock counterparts.

Portfolio allocation

Over the quarter, on the equity side, the Fund has benefited from its wide and diversified geographic exposure. Especially, our high convictions in China recorded substantial gains, leading us to outperform our reference indicator. Also, our investment approach focusing on secular growth has continued to pay off, illustrated by our gains in the technology, healthcare and consumer space. In these sectors, we were able to generate significant alpha thanks to some of the long term thematics we focus on. These include climate change, that led us to invest in electric car companies and battery producers, notably in China. Finally, we added in April/May names that we felt had suffered a lot from the crisis but would benefit from steady reopening of economies. Among them, Amadeus, a Spanish IT provider for the global travel and tourism industry and Safran, a jet engine manufacturer focused on short haul tourism flights. These positions allowed us to mitigate the impact of a value catch up towards the end of the year.

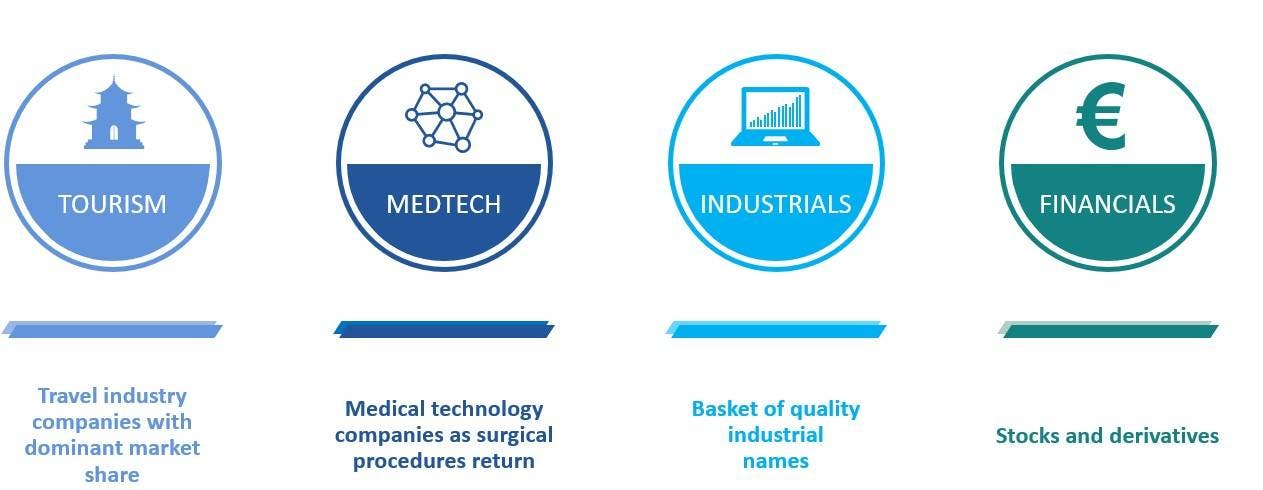

Playing of the Reopening of Economies & US Fiscal Stimulus

Source: Carmignac, 12/2020

Portfolio composition may change

On the fixed income side, we also benefited from this value catch up via our credit names in cyclical sectors. In response to overall market conditions, we shortened the modified duration of our fixed-income portfolio at the end of the year. We also moved to give greater weight to medium-term maturities (protected by what we expect will be stable yields in both Europe and the United States), as well as to corporate and bank bonds offering high enough spreads to be able to take an interest-rate shock in their stride. In the United States, we bought credit protection on the long end of the yield curve (30 years) and Treasury inflation-protected securities. We believe the credit segment still offers a lot of value, and above all dispersion. On the whole, though spreads have narrowed substantially in the past few months, a number of previously mentioned sectors still hold potential for appreciation and attractive returns.

The US dollar fell roughly 9%1 against the euro in the course of 2020, and the slide may well continue, as we expect the twin US deficits (trade and fiscal) to weaken the greenback long-term. Our exposure to the US currency will therefore be hedged. In contrast, the renminbi is backed up by solid fundamentals. China is running a trade surplus, shows real competitive strength and offers what are practically the world’s highest real interest rates. Thus, in addition to our euro exposure, we are positioned to benefit from appreciation in the Chinese currency.

Outlook

Over the long term, we believe secular growth stocks that we find in Tech and Internet, but also Health Care & Consumer, will keep performing well because of their superior growth prospects and business models. Nevertheless, we are cautious on high valuation stocks and took profits on the key beneficiaries of the “stay at home” economy and Chinese names.

It looks like three key themes will be shaping events in 2021:

- The cycle of falling yields came to an end in the fourth quarter of 2020. Our flexible approach to risk management will allow us to actively manage the potential impact of rising interest rates on our bond portfolio and on the valuations of certain stocks we hold.

- Covid-19 vaccination campaigns in 2021 should pave the way to a gradual return to normal lifestyles, and with it to higher revenue in sectors such as travel, energy and banking that are dependent on such a return to normal.

- Lastly, fiscal and monetary policy support will remain crucial to easing the transition to growth fuelled entirely by economic expansion. In the US, such support will be accompanied by a dual change of policy orientation: the new Democratic administration marks the revival of Keynesian-style stimulus policies, and the Federal Reserve is now aiming for an average inflation rate of 2% rather than a hard target of 2%, which suggests inflation may at times move above 2%.2 We expect this combination to lead to dollar depreciation and a pick-up in world trade – two factors that will work to the advantage of emerging markets.

* For the A EUR acc share class. 50% MSCI ACW NR (USD) (Reinvested net dividends) + 50% ICE BofA Global Government Index (USD). Quarterly rebalanced. 1 Source: Bloomberg, 31/12/2020 2 Source: US Federal Reserve, 31/12/2020

Carmignac Patrimoine A EUR Acc

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

2025 (YTD) ? Year to date |

|

|---|---|---|---|---|---|---|---|---|---|---|---|

| Carmignac Patrimoine A EUR Acc | +0.72 % | +3.88 % | +0.09 % | -11.29 % | +10.55 % | +12.40 % | -0.88 % | -9.38 % | +2.20 % | +7.06 % | - |

| Referentie-indicator | +8.35 % | +8.05 % | +1.47 % | -0.07 % | +18.18 % | +5.18 % | +13.34 % | -10.26 % | +7.73 % | +11.44 % | - |

Scroll rechts om de volledige tabel te zien

| 3 jaar | 5 jaar | 10 jaar | |

|---|---|---|---|

| Carmignac Patrimoine A EUR Acc | -0.28 % | +2.01 % | +1.27 % |

| Referentie-indicator | +2.51 % | +5.13 % | +6.06 % |

Scroll rechts om de volledige tabel te zien

Bron: Carmignac op 31/12/2024

| Instapkosten : | 4,00% van het bedrag dat u betaalt wanneer u in deze belegging instapt. Dit is het hoogste bedrag dat u in rekening zal worden gebracht. Carmignac Gestion brengt geen instapkosten in rekening. De persoon die verantwoordelijk is voor de verkoop van het product zal u informeren over de feitelijke kosten. |

| Uitstapkosten : | Wij brengen voor dit product geen uitstapkosten in rekening. |

| Beheerskosten en andere administratie - of exploitatiekos ten : | 1,50% van de waarde van uw belegging per jaar. Dit is een schatting op basis van de feitelijke kosten over het afgelopen jaar. |

| Prestatievergoedingen : | 20,00% max. van de meerprestatie als het rendement sinds het begin van het boekjaar hoger is dan dat van de referentie-indicator en er geen minderprestatie uit het verleden meer moet worden goedgemaakt. Het feitelijke bedrag zal variëren naargelang van de prestaties van uw belegging. De schatting van de totale kosten hierboven omvat het gemiddelde over de afgelopen vijf jaar, of sinds de introductie van het product als dat minder dan vijf jaar geleden is. |

| Transactiekosten : | 0,79% van de waarde van uw belegging per jaar. Dit is een schatting van de kosten die ontstaan wanneer we de onderliggende beleggingen voor het product kopen en verkopen. Het feitelijke bedrag zal variëren naargelang hoeveel we kopen en verkopen. |

* 50% MSCI ACW NR (USD) (Reinvested net dividends) + 50% ICE BofA Global Government Index (USD). Quarterly rebalanced. Past performances are not a guide to future performances. The return may increase or decrease as a result of currency fluctuations. Performances are net of fees (excluding possible entrance fees charged by the distributor). The Fund presents a risk of capital loss. Risk Scale from the KIID (Key Investor Information Document). Risk 1 does not mean a risk-free investment. This indicator may change over time.

Carmignac Patrimoine E EUR Acc

Het indicator kan variëren van 1 tot 7, waarbij categorie 1 overeenkomt met een lager risico en een lager potentieel rendement, en categorie 7 met een hoger risico en een hoger potentieel rendement. De categorieën 4, 5, 6 en 7 impliceren een hoge tot zeer hoge volatiliteit, met grote tot zeer grote prijsschommelingen die op korte termijn tot latente verliezen kunnen leiden.

Aanbevolen minimale beleggingstermijn

Laagste risico Hoogste risico

Risico's die in de indicator niet voldoende in aanmerking worden genomen:

KREDIETRISICO: Het kredietrisico stemt overeen met het risico dat de emittent haar verplichtingen niet nakomt.

TEGENPARTIJRISICO: Risico van verlies indien een tegenpartij niet aan haar contractuele verplichtingen kan voldoen.

Inherente risico's:

AANDELENRISICO: Risico dat aandelenkoersschommelingen, waarvan de omvang afhangt van externe economische factoren, het kapitalisatieniveau van de markt en het volume van de verhandelde aandelen, het rendement beïnvloeden.

RENTERISICO: Renterisico houdt in dat door veranderingen in de rentestanden de netto-inventariswaarde verandert.

KREDIETRISICO: Het kredietrisico stemt overeen met het risico dat de emittent haar verplichtingen niet nakomt.

VALUTARISICO: Het wisselkoersrisico hangt samen met de blootstelling, via directe beleggingen of valutatermijncontracten, aan andere valuta’s dan de waarderingsvaluta van de ICBE.

RISICO VAN KAPITAALVERLIES: Dit deelbewijs/deze aandelenklasse biedt geen garantie voor of bescherming van het belegde kapitaal. U ontvangt mogelijk niet het volledige belegde bedrag terug.

Meer informatie over de risico's van het deelbewijs/de aandelenklasse is te vinden in het prospectus, met name in hoofdstuk "Risicoprofiel", en in het document met essentiële beleggersinformatie.